Bluefin tuna – an iconic example for recovery

Bluefin tuna is known for its size and price. A new management strategy is to ensure the long-term sustainable management of the stocks in the Atlantic.

Put on your goggles and dive into the promising Fish & Seafood sector: An attractive investment option, which for the most part is still undiscovered, provides a historically favorable opportunity. The industry leaders are currently valued at the same level as 2013/2014, while companies have been able to strengthen their positions over the last ten years. That is what makes entering the Fish & Seafood sector highly attractive right now.

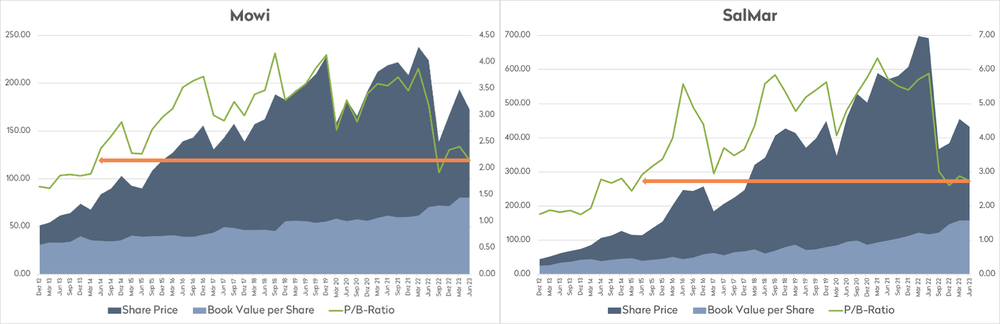

Industry leaders Mowi and SalMar are valued at the same price-to-book ratios as 2013/2014...

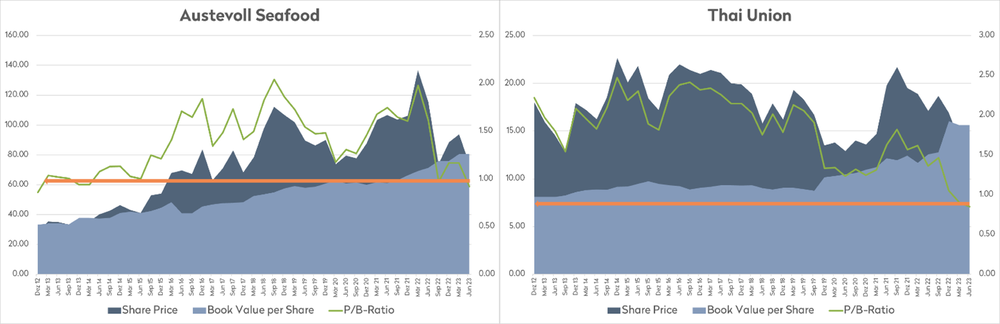

...whereas Austevoll Seafood and Thai Union can be bought for less than the amount of their reported assets.

The last time these valuations occurred, the Global Fish Fund generated a return of 10.76% p.a. (1) from 2014 to 2019.

In somewhat secluded waters, far from the cult and the hype, stock values of companies that produce basic everyday foodstuffs continue to bob along unnoticed. They will generate their revenues, and they will have to grow, because there are 53 million people (2) more living on this planet since the beginning of 2023 alone. Furthermore, estimates suggest that the middle class, which wants to live according to Western standards, will grow by 900 million people between 2020 and 2030. The wealthier they are, the more meat proteins end up on consumers’ plates. Yet our resources are limited – we only have one Earth. The seafood sector offers obvious solutions. Compared to land-based animals, selected fish species can gain one kilogram of body weight for every kilogram of feed. Cattle fed with concentrated feed require 6-10 kilograms. The ocean offers untapped expanses, and it is only a question of time before aquacultures enter into rough waters and provide us with additional protein from the world’s oceans. With new laws such as the ban on importing raw materials like soy from deforested areas and the demand for CO2 reductions in factory farming, politicians are clearly pointing in the direction of aquaculture as a promising solution for the future.

The Bonafide Global Fish Fund provides investors with the unique opportunity to participate in these forward-looking developments in the food sector, which are extremely important to humanity. The Fund invests in pioneering companies with many years of expertise in coastal regions. The assets of these companies are currently valued at the most attractive level in the last 10 years. Let’s take a look at the top companies in the Fund, which are all from Norway. They are currently being traded at valuations similar to those from 2012 to 2014. Just a few years ago, the market paid twice that amount. These companies have improved their vertical integration and strengthened their positions. Austevoll Seafood, for example, controls almost everything from fish oil and fish meal in the South Pacific and North Atlantic to its own brand of salmon in Japan. And yet many stock exchange participants are only interested in the weekly spot price for salmon to make money with short-term speculation. This phenomenon is not only limited to Norway and salmon, but can be observed globally across the sector and therefore in the Fund. Thai Union, which remains a cash cow business producing low-cost cans of tuna and would benefit from recessionary forces, has never been this affordable since the Fund was launched in 2012. Other examples from Japan or Chile show the same pattern. A low price-to-book ratio would be appropriate if there were problems with profitability or the balance sheet. However, recent distributions in the form of dividends and the outlook for the next five years suggest otherwise. Long-term investors currently have a unique opportunity to benefit from attractive returns with manageable risk.

Get on board with us and benefit from the opportunities of the #BlueRevolution.

Your Bonafide

Legal notice

(1) Returns in EUR, NAV data retrieved from https://www.ifm.li

(2) As at July 12, 2023. Source: https://countrymeters.info/de/World

This publication is a marketing communication. Our analyses and investment forecasts are carefully prepared, but can never be a guarantee of future performance. Please note that the value of an investment can increase as well as decrease. The future performance of an investment cannot be deduced from past performance. Investments in foreign currencies are subject in addition to exchange fluctuation rates. Investments with high volatility can be exposed to high price fluctuations. These price fluctuations may equal or even exceed the amount invested. The preservation of the invested capital can therefore not be guaranteed. The acquisition of investment funds should take place after carefully reviewing the corresponding sales prospectus and previous annual report (and semi-annual report if this is up to date) along with the usual legally applicable documents (regulations and contract conditions, statues and simplified prospectus if applicable). These documents can be obtained free of charge for the investment funds in Liechtenstein listed in this publication from the IFM, Independent Fund Management AG, Landstrasse 30, 9494 Schaan or from Bonafide Wealth Management AG, Höfle 30, 9496 Balzers.

Comments