Bluefin tuna – an iconic example for recovery

Bluefin tuna is known for its size and price. A new management strategy is to ensure the long-term sustainable management of the stocks in the Atlantic.

Im März 2023 fand das North Atlantic Seafood Forum in der Seafood-Hauptstadt Bergen statt. Trotz wirtschaftsfeindlicher Politik im ressourcenreichen Norwegen verzeichnete die Konferenz eine Rekordzahl an Teilnehmern. Bonafide gehört seit 2012 zu den Stammgästen an diesem wichtigen Industrie-Anlass. Nebst spannenden Unterhaltungen mit Managern aus allen Ecken dieser Welt, brachten die Konferenzpräsentationen wichtige Erkenntnisse zu Tage. Nachfolgend teilen wir drei Eindrücke, die uns besonders in Erinnerung blieben.

The opening speech at the conference is usually given by a Norwegian politician and, despite fierce expropriation plans by the current government, this tradition was upheld. The Minister of Fisheries opened the session with a speech entitled “Inspiration” and talked about numerous recent and ongoing crises facing the population, the economic sector and the political sphere. We have not yet seen the end of the coronavirus pandemic or its effect on global supply chains. For almost two years now, we have also been struggling with soaring inflation rates that have advanced to dizzying heights. Energy costs in Europe have more than doubled; everyone is feeling the pinch. And for just over a year, a war has been raging in Eastern Europe, which has brought further difficulties, such as the movement of refugees. Listeners were eager to hear about the Norwegian government’s resource tax on salmon farms, which is currently triggering the next supply crisis and is clipping the wings of Norway’s number one growth industry. But as politicians do, the minister beat around the bush. Without mentioning the resource tax once, he left the podium to lukewarm applause after giving a speech which lasted less than ten minutes. In our many conversations with other conference participants, there was a sense of disappointment in Norway’s government. Opinions varied widely on what the results of the resource tax might be. But the most important thing for the industry is to have clarity so that investment calculations can get under way again. Aquaculture companies will continue to grow, whether in Norway or elsewhere.

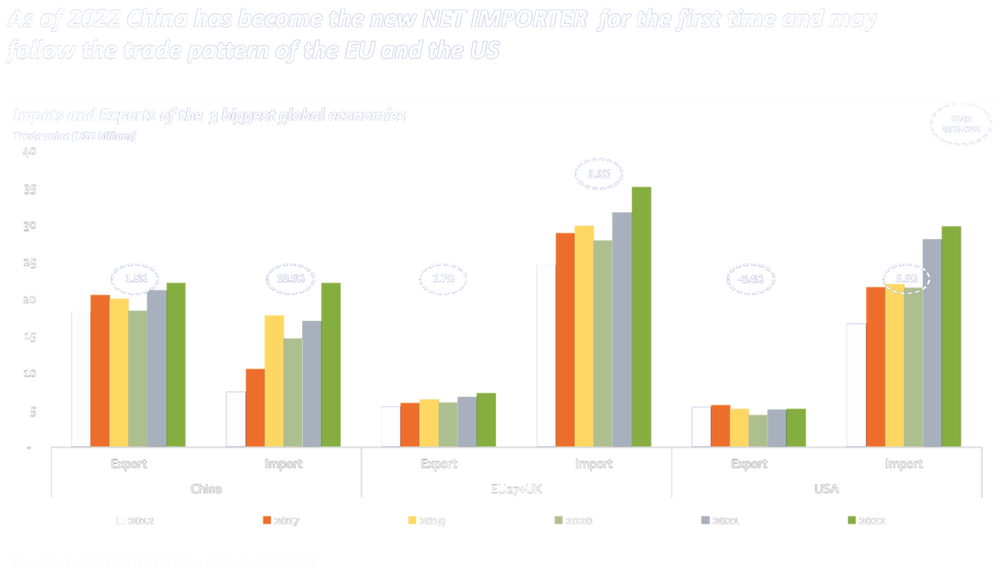

When it comes to food and commodities, global trade flows always reveal important developments. Although China’s carp farming means it can be classified as an aquaculture nation, something remarkable happened in 2022. Measured in terms of trade values in USD, China became a net importer of fish and seafood for the first time. In just ten years, China’s appetite for foreign fish has tripled. Imports have risen from USD 7 billion in 2012 to USD 22 billion last year, an annualised growth rate of 10.5%. Exports have grown by just 1.8% per year over the same period. China is therefore following in the footsteps of the two global markets Europe and the US, whose trade balances in this category are drifting more strongly into negative territory year after year. The demand for high-quality proteins with a low carbon footprint has persisted for years. The governments of importing nations need to think about self-sufficiency or, alternatively, maintain good relations with exporting nations. Climate change is also pushing the world’s population to increase resource efficiency, and this is where aquaculture plays a crucial role. In uncertain times, when commodities are also becoming scarce, investors should base their investment decisions on long-term developments. In the coming years, food producers should clearly be in the stronger bargaining position. China’s example is merely another confirmation of this megatrend.

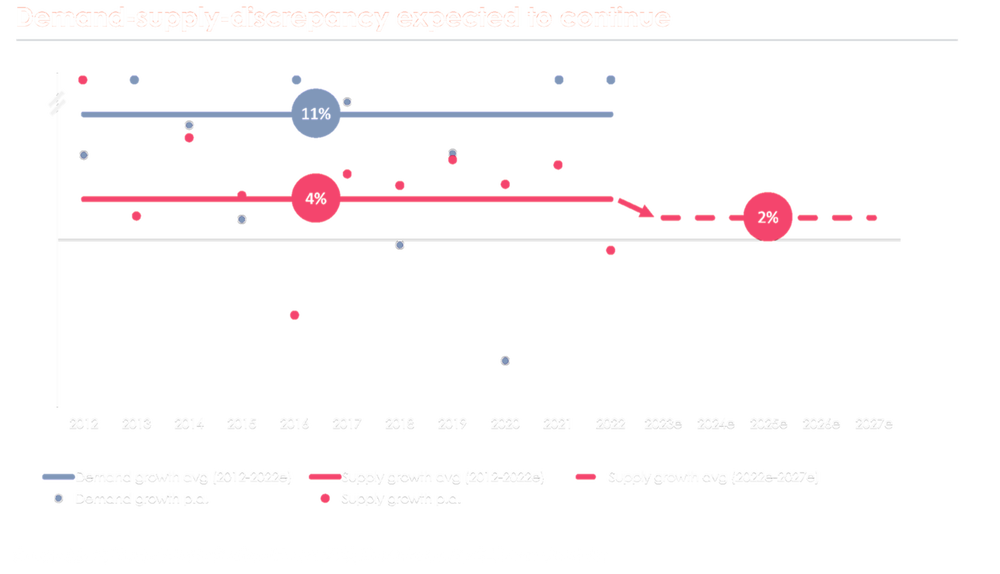

The presentation by Mowi, the world’s largest aquaculture company, left us all with goosebumps. Although we have known for some time that salmon supply growth will be low due to regulation and deteriorating conditions (e.g. the resource tax in Norway), until now no company had expressed it so clearly. Mowi expects an average supply growth of 2% until 2027. For the last ten years, volume growth has been 4% annually. If the desire to buy salmon continues to grow at 11% per year in the coming years, this species of fish will soon be converted into a luxury item. But even with a markedly lower growth in demand, there is only one direction for the price of salmon and that is up. And probably for a longer period than some seafood analysts implied in their expectations today. Uncertainties surrounding the resource tax are currently overshadowing these fundamental data, which have never been as good for salmon farmers as they are in the current environment.

Comments